Are you looking for innovative debt consolidation strategies? You’re not alone. According to the Federal Reserve Bank of New York, total household debt rose to $17.69 trillion this quarter.

Traditional methods seem less effective as debt continues to rise, highlighting a need for more creative ways to resolve and manage debt.

Debt isn’t always easy to handle. Knowing that there are more creative options for managing debt reduces your stress.

Technological advancements offer personalized solutions that consider your unique circumstances. Blockchain provides secure and transparent transactions, and like peer-to-peer models, cuts out the middleman and saves you money.

Understanding debt consolidation

Debt consolidation helps you avoid juggling multiple lenders with varying interest rates. It typically involves getting a loan through a company like United Financial Network to cover existing debts.

You may get better payment terms by combining several debts under one loan, along with lower monthly repayments and reduced interest rates.

Consolidating debt is an effective way to reduce the challenges of handling many loans. It can help you repair your credit score and live debt-free.

There are many ways to consolidate debt and get lower interest rates. The most common option is a consolidation loan or transferring your debts to a single credit card. Other traditional debt consolidation methods include:

- Home equity loans

- Debt management plans

- Personal loans

- Borrowing from retirement accounts

- Debts settlement

These aren’t the only methods, though. As technology advances, more innovative debt consolidation solutions pop up. AI, blockchain, and even your peers may be able to help you.

Adapting to new financial tools and strategies can make consolidating debt less stressful and more beneficial.

Assessing your debt situation

The most important thing to do when creating a plan to handle your loans is to assess your debt situation. Take a detailed look at everything you owe and list out the following information for each one:

- Debt type (e.g. credit card or student loan)

- Interest rate

- Total balance

- Lender

- Monthly payment

This list gives you a clear picture of what you owe. It comes in handy once you determine your repayment strategy. Understanding your debt situation also highlights the risks and benefits of consolidation strategies.

Using debt assessment tools in 2024, like consolidation calculators, helps summarize your debt and interest. It shows you the total amount you owe and gives you an average weighted interest rate. You can compare this data against what lenders offer.

A lower interest rate is the ideal outcome. Remember that your debt-to-income ratio (DTI) and credit score also affect what lenders offer you.

Top innovative debt consolidation strategies for 2024

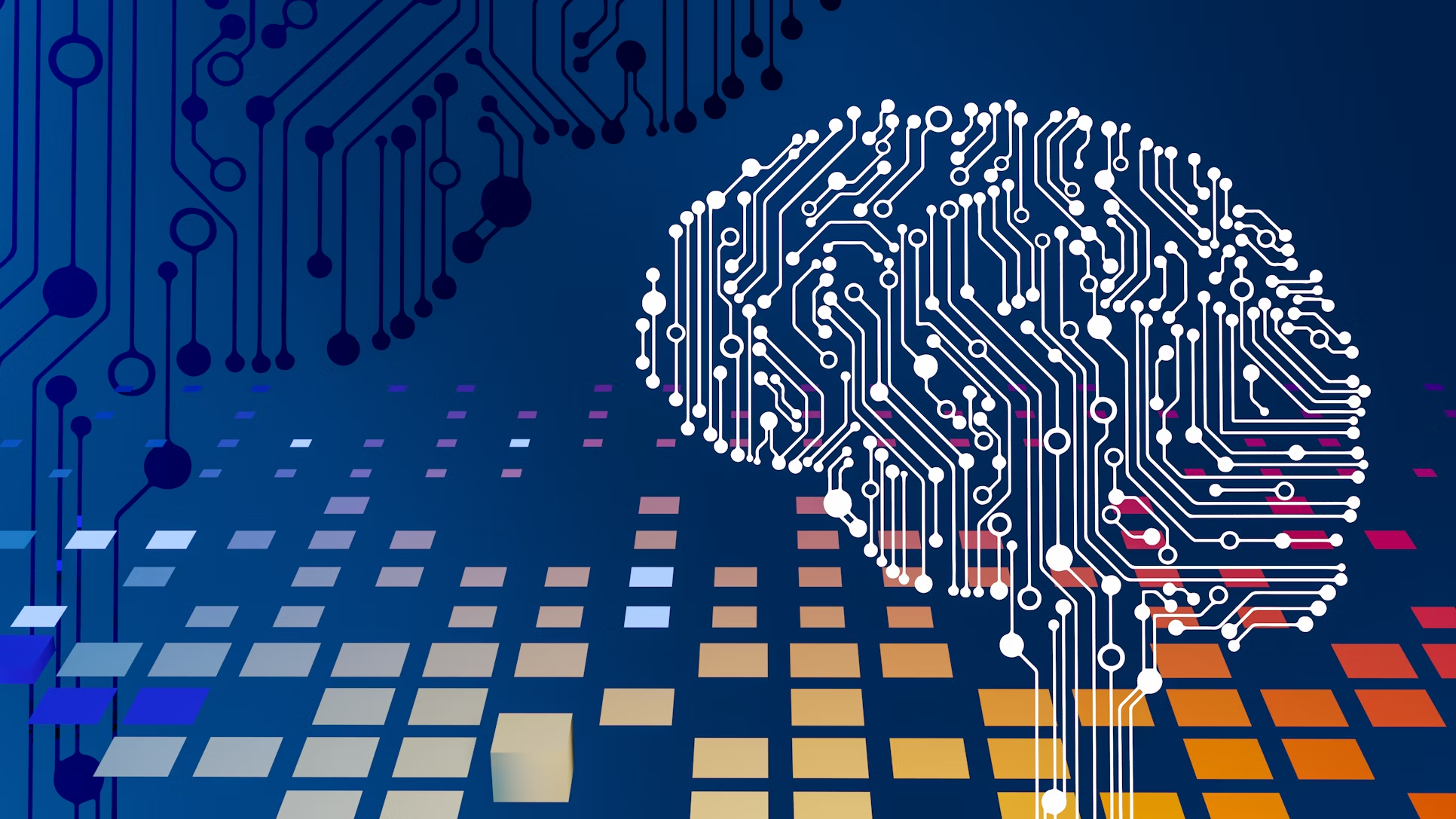

Advancements in technology are getting broader every day. They don’t just help you manage your workflow or answer questions faster than Google.

Technology can also give you innovative debt consolidation strategies. It offers various benefits to you and the financial institutions that help you. United Financial Network is leading the way in finding new and creative ways to consolidate debt.

AI-driven advisors, apps for automated debt management, and personalized approaches are some of the innovative strategies we’ve uncovered.

AI-powered debt consolidation platforms

UFN is constantly searching for innovative ways to help you consolidate your debt. Artificial intelligence (AI) is at the forefront of these leaps.

Generative AI companies have many solutions for you to take advantage of. They use existing patterns and data to provide personalized debt plans and AI financial advisory services.

AI-powered debt consolidation offers various advantages, including strategies and advice for your circumstances. It considers interest rates, credit score impact, and repayment terms to predict the most efficient consolidation strategies.

These platforms use real-time monitoring to track your financial situation and offer you the best advice. Some apps let you set up automated payments, so you don’t have to worry about managing them individually.

There are many AI debt consolidation strategies available. These platforms work with leading financial institutions, like UFN, to help you manage your debt effectively.

Peer-to-peer lending

Peer-to-peer (P2P) lending is a debt consolidation strategy that lets you cut out the middlemen and get loans from individuals. It connects you directly to potential lenders.

P2P debt consolidation websites enable transactions and set the terms and rates, which can vary depending on your creditworthiness.

Investors set up accounts with the site and deposit money. The site uses it for debt consolidation loans for applicants who post their financial profiles.

Your financial profile categorizes your risk level and sets the interest rate on your loan. Offers will come through, allowing you to choose between them. The platform usually handles the monthly repayments and transfers.

United Financial Network offers P2P solutions through various types of lenders. We provide comprehensive services, ranging from student loan debt to medical and business debt.

Blockchain-based solutions

Blockchain-based debt consolidation strategies provide financial transparency, security, and efficiency to help track and manage debt transactions.

Studies show blockchain consolidation methods are more transparent and secure. They reduce risks by using digital encryption and time-stamping technologies to monitor transactions.

Blockchain debt consolidation removes intermediaries, allowing you to communicate and settle on terms directly with lenders. The improved security, debt recovery, and automated enforcement potential also mean lenders face less risk if you default.

You may get better rates due to the lower risk. Lenders also have the potential for higher returns. UFN strives to integrate innovative debt consolidation strategies like blockchain to benefit you and the lender.

Customized debt management plans

Debt management plans (DMPs) are structured agreements with a credit counseling agency. They’re like a roadmap to help you reduce and remove your debt within a reasonable time frame.

Companies like UFN create customized debt management plans to suit your specific situation. They negotiate with your creditors for better payment plans, interest rates, and fees.

Personalized DMPs use various debt consolidation strategies to tailor your budget according to your income and expenses. They may save you money, improve your credit score, and reduce debt and financial stress.

There are some downsides to using a DMP. They temporarily dip your credit score and may put you in more debt if you don’t stick to them.

The key to debt management success is understanding interest rates. They have a major impact on loans and consolidation strategies. Our United Financial Network advisors guide you through all the pros and cons before setting up a customized DMP.

Home equity line of credit

A home equity line of credit (HELOC) works similarly to a home equity loan (HOL). It lets you borrow money against your home equity. The difference is that you don’t take a lump sum, but a credit line.

A HELOC lets you use what you need as you need it. You can take the monthly repayment amount and repay it during the draw period.

The benefit of this debt consolidation strategy is that you don’t pay interest on the approved lump sum. You pay it on the amount you borrow as you use it. A HELOC can offer lower interest rates that are usually tax deductible.

Debt avalanche and snowball method

There are two excellent yet simple methods to help you organize your payments: debt snowball and debt avalanche.

- Debt snowball method: This strategy creates a “snowball effect” as you pay your debts. You start by paying the minimum across all of them and add extra on the smallest. It helps you pay off the lowest balances first, clearing debt quicker.

- Debt avalanche method: This method helps you save on interest and puts more money in your pocket in the long run. You pay the minimum across your debts and add more to the one with the highest interest rate.

Financial planning for debt relief isn’t only about managing your money today. It ensures sustainability for years to come. Who doesn’t want to be secure in their finances in the future?

UnitedFN commits to your financial health by standing with you throughout this journey. Our expert advisors provide continued personalized financial guidance. We help you navigate challenges and leverage new growth opportunities.

Take proactive financial steps by assessing your current situation and setting clear goals. Start building retirement and emergency funds. Use sustainable strategies like debt consolidation or the snowball or avalanche methods.

Are you ready to secure your financial future? Contact UnitedFN today so we can find a tailored strategy that works for you.

Leveraging technology for debt management

Technology has opened up opportunities to streamline the debt consolidation process. The most significant developments are financial apps for debt management.

There’s a wide range of debt management software known as debt payoff apps. They structure your debts, track your progress, and help you make payments through a user-friendly hub.

Debt payoff apps translate your finances into understandable data through educational tools. Here are three major ways they simplify your debt consolidation strategies:

- They give you an overview of your financial health.

- They analyze your debt and provide solutions to manage them.

- They automate payments so you don’t run late and incur fees.

Here are some of the most popular debt payoff apps to manage and track debt in 2024:

- Debt Payoff Planner

- Tally

- Bright Money

- Qapital

- Debt Payoff Assistant

Benefits of professional debt consolidation services

The benefits of debt consolidation vary depending on what you owe and the offers you get from lenders.

United Financial Network offers professional consolidation services that ensure you get the most effective services. We pay attention to you and your circumstances and find the best debt consolidation strategies for your needs.

Here are some of the key benefits you can expect from our professional debt consolidation services:

- Simplified and faster debt repayments through a consolidation loan with a single monthly amount.

- The potential to improve your credit score by making regular, on-time payments.

- The chance to get better interest rates than your average weighted rate.

- Access to innovative debt consolidation strategies that make your life easier and save you money.

- Higher chances of negotiating better loan terms that reduce your overall repayment.

- You’re more likely to get a fixed repayment schedule, so your payments remain the same and budgeting is easier.

United Financial Network is a leading debt consolidation platform, with plenty of wins under our belt. Don’t believe us? We have dozens of testimonials from satisfied clients to prove it.

Preparing for the future trends in debt consolidation

Preparing for the future is no simple task. Trends change, and the steps you need to take may seem unclear. Understanding these changes can help you make effective decisions about managing your debt.

Here are the most significant future debt consolidation trends we foresee thanks to technological advancements in debt management:

- Maturing AI for debt collection and management.

- AI that helps with vendor consolidation.

- Technology that improves process automation for debt repayments.

- Lenders that use technology to determine who can afford to repay them.

When you’re able to prepare for debt trends, building a plan for managing your loans becomes easier. To start debt consolidation, follow these few simple steps:

- Check your credit score

- Develop a DMP and set financial goals

- Contact United Financial Network

- Compare loan offers

- Apply for a debt consolidation loan

- Create a budget and repay the loan

Start your debt consolidation journey with UFN

Getting out of debt doesn’t have to be a complicated process. There are various debt consolidation strategies to make your life easier.

You can choose from many strategies when you use professional debt consolidation services. Gain access to traditional and innovative methods to streamline your debt management.

United Financial Network offers innovative strategies to help you get the most effective debt consolidation services. Contact us today and get on the path to living a debt-free life.