Understanding debt consolidation loans

Important considerations for choosing the best debt consolidation loans

Lenders offering debt consolidation loans

Eligibility and qualification criteria

The application process for debt consolidation loans

Alternatives to debt consolidation loans

Tips for managing debt after consolidation

Get your debts in order

Are you struggling with financial repayments? Find relief with the best debt consolidation loans in the USA.

Say goodbye to the stress of managing multiple borrowings and due dates. Merging your debts into one loan simplifies the repayment process. It may also save you money, freeing it for other purposes.

Finding the right solution to your situation can be daunting. You could experience information overload.

Don’t stress, though. We have the answers you seek. Keep reading to explore debt consolidation loans and how they work. Learn how to avoid the pitfalls and choose the one offering financial freedom.

Let’s dive in.

Understanding debt consolidation loans

Being in debt is hard. Meeting monthly minimum payments can take a toll on your finances.

It may be time to consider debt consolidation loans in the USA if you’re in this situation. Don’t ignore or defer your obligations. The longer you wait, the more complicated they become.

You could face severe consequences, depending on the type of debt. With a secured loan, you risk losing your assets. If your house is the collateral, the lender could foreclose, and you might have to sell your home.

Being delinquent on payments towards unsecured loans has different outcomes. You won’t lose your possessions, but you could have debt collectors hounding you.

Expect to incur late fees and higher interest rates. Your credit score drops, making it difficult to get a loan in the future. Your lender might also sue you.

There’s a way to protect your financial interests before you default on your repayments. Combine your borrowings into one debt consolidation loan. Rather than juggling payments and managing due dates, you focus on paying off a single debt.

How debt consolidation loans work

How do debt consolidation loans solve your financial woes? They allow you to combine various borrowings into one. You end up with a single interest rate and only one monthly payment.

These loans usually offer lower interest rates and a longer tenure. Your chances of getting a low rate are higher if you have a good FICO credit score. Ideally, besides saving on interest charges, you reduce your monthly payments.

Not all debt consolidation loans in the USA are the same. Although the goal is the same for all options, the methods and results vary. Be sure to understand and evaluate the available options before deciding.

Don’t confuse debt consolidation with debt relief. The latter involves reducing the amount you owe. You may have to negotiate with your creditors to accomplish your objective.

Types of debt consolidation loans

You’ll come across secured and unsecured loans when looking for a debt consolidation fund. What are they, and how do they work?

Secured debts require collateral to protect the lender’s interests. A car loan and mortgage are such loans. If you default on payments, you risk losing your automobile or home to the lender.

Unsecured debts include student loans, medical bills, payday loans, and credit card facilities. Unlike secured debts, lenders cannot take over your assets if you do not pay what you owe.

Non-repayment of the loan can lead to a negative credit score. The lender may take you to court to garnish your wages to recover their money.

Debt consolidation loans help you save on interest and settle your debt faster. Use the funds to pay off multiple borrowings, leaving only one account to manage. These loans generally have a fixed interest, although variable rates are also available.

Pros and cons of debt consolidation loans

Although debt consolidation loans can be lifesavers, ensure the benefits outweigh the costs. There are advantages and disadvantages to consider before applying for a loan.

Pros

The primary purpose of a debt consolidation loan is to combine multiple borrowings into one. You end up with a single lender, repayment amount, and due date.

You might get a lower average interest rate, reducing your monthly payment. Besides freeing up extra cash, the lower repayment helps you pay on time. Prompt payment history can raise your credit score.

Cons

Beware of extra payments to consolidate your debts. Some lenders charge an origination amount to open the account. The quantum is equal to a percentage of the loan sum. If you’re transferring an amount to your credit card, there’s a fee based on the transfer balance.

The other potential pitfalls are incurring more interest and accumulating additional debt. You may

pay more interest in the long run if you extend the loan repayment term. Be careful not to rack up extra debt by spending the freed usable balance.

Debt consolidation won’t fix your problem if you don’t change your spending habits. Not dealing with the root cause will lead to a repeat of your financial situation.

Important considerations for choosing the best debt consolidation loans

Choosing the best debt consolidation loans in the USA may be challenging, but it doesn’t have to be. Knowing your needs helps you narrow your choice of lenders.

Analyze the following factors to determine which option meets your goals.

Interest rates

Interest rates are a critical factor that impacts the success of your consolidation goal. There are loans with fixed and variable rates. Payments toward the former are constant, while the amount for the latter fluctuates.

Shortlist at least three lenders to assess potential loan costs and compare them. Use their rate-check tool to help you. You’re more likely to get a lower interest rate with an excellent credit score.

Loan terms and repayment plans

Besides the interest rate, it’s vital to know the following details.

- Loan sum: The amount should cover the borrowings you want to consolidate.

- Repayment period: Choose a shorter term, as interests can add up in the long run.

- Monthly payments: The amount should fit your budget.

- Due date: Ideally, check for loans that allow you to alter the due date when circumstances change.

- Fees: Be aware of charges and hidden costs.

Some lenders may also impose restrictions on how you use their money. Pick a lender with terms that suit your goal. Also, look for loans offering several payment methods for convenience.

Fees and associated costs

Almost every lender charges an origination fee, which is your borrowing cost. Look for those that don’t impose any charges. You might qualify for such loans with good to excellent credit.

Other charges that can increase your loan cost include prepayment and late fees. The latter is avoidable, so ensure your payments are on time.

Lender reputation and credibility

Banks are regulated and generally have no credibility issues. The disadvantage is that they have more stringent requirements.

You may seek other lenders if you have poor credit. If they’re not regulated, do your homework to learn what other consumers say about them.

Read reviews on Trustpilot and check the Better Business Bureau. The Consumer Financial Protection Bureau’s Consumer Complaint Database is also a good reference.

Lenders offering debt consolidation loans

Below are legal funding sources to consider when looking for debt consolidation loans.

Traditional banks

Traditional banks are financial institutions with a physical presence. They offer many services, including personal loans for debt consolidation. Some people prefer dealing with banks because of human interaction.

Bank interest rates tend to be high because they’re profit-oriented. Their requirements are also more stringent.

Credit unions

Unlike traditional banks, credit unions are member-owned and managed non-profit institutions. They focused on profits less than banks, so their interest rates are more competitive. Their loan terms are also more flexible.

Consider credit unions if you don’t meet stringent credit requirements. They’re more likely to help. Processing times vary, but you might get the funds within two days after approval.

Online lenders

An online personal loan may suit you if you need fast funding and competitive interest rates. You don’t need to provide collateral for these unsecured funds.

Lenders rely on your credit score, income, and other financial qualifications for approval. You can complete the loan application online without any face-to-face meetings. Funds will be available as early as a day after verifying your information.

Check if the lender is reputable before providing personal details. Due diligence is necessary to avoid online scams.

Peer-to-peer lending platforms

Individuals or groups of individuals fund peer-to-peer (P2P) personal loans. P2P lenders may require less stringent qualifications than traditional financial institutions.

P2P lending platforms link borrowers with investors willing to lend money. The P2P marketplace manages the application and approval process and sets interest rates. Borrowers don’t deal directly with their financiers.

Ask family and friends with P2P experience for referrals if you don’t know where to begin your search. Read customer reviews to learn more about each lender.

Qualifying for a P2P loan is easier if you have bad credit. The flip side is that the hard credit check requirement can cause your score to drop.

Private lenders

You may borrow from family and friends if you need cash. Have a written agreement stating the terms and conditions to avoid disputes.

Eligibility and qualification criteria

Review your debt status before looking for a debt consolidation loan. Request payoff amounts for each borrowing. Note that lenders have amount restrictions. Be sure to choose one that allows you to consolidate all your debts.

Most lenders look at the criteria below.

Credit score

Lenders require at least fair or good credit before offering loans. Generally, a high FICO score boosts your chance of approval. There are options for bad credit borrowers if you don’t qualify.

Income

There might be a minimum annual income requirement. Lenders also consider your debt-to-income (DTI) ratio. A lower figure shows a good balance and that you can repay what you owe. Some debt consolidation loan companies accept a DTI ratio as high as 50%.

Credit history

Bankruptcies, tax liens, repossessions, or foreclosures can jeopardize approval chances. Some lenders allow a co-signer or joint applicant to reduce their risk.

Collateral

Lenders will evaluate your assets if you apply for a secured loan. Your house is an excellent collateral to help you qualify for financing.

The application process for debt consolidation loans

Follow these application steps if you’re eligible for a debt consolidation loan.

Shop for low-interest loans

To maximize your results, you need a low interest loan. Compare rates to find one that helps you save. Don’t worry about shopping around. Pre-qualification only triggers a soft check, which doesn’t hurt your credit score.

Prepare the relevant documentation

Compile the required information and documentation before applying. While the requirements vary, you’ll need to provide the following documents.

- W-2s, 1099s, pay stubs, or tax returns.

- Birth certificate, social security card, driver’s license, or passport.

- Utility bills, lease or rental agreements, financial statements, or voter registration cards.

Check with the lender for a list of required info so you don’t miss any documents.

Submit your application

Submit your application when you have all the necessary documents ready. Some lenders offer online applications. Others, like banks and credit unions, may require you to visit a branch to apply.

Sign the agreement and receive your money

The final step of the application process is the approval. The process may take time, depending on the financial institution. Traditional banks and credit unions usually take more time to decide. You may receive a quick decision if you apply online.

Review the loan documents and clarify everything before signing on the dotted line. The lender will disburse the proceeds after processing your file.

Alternatives to debt consolidation loans

Debt consolidation loans aren’t the only options to solve your financial issues. Here are several alternatives to consider.

Balance transfer credit cards

Transferring your debts onto a single credit card is an option. Credit card companies usually offer 0% APR to entice competitors’ clients. The rate applies to an introductory period. Some lenders may charge a 2–5% transfer fee.

You may need excellent credit to qualify. Ensure that the approved transfer limit is enough to cover what you owe.

The balance doesn’t incur any interest during the 12–18 months tenure. There’s a minimum sum, but you can pay as much as you want. 100% of the payments go toward the principal amount, helping you settle the debt faster.

Pay off the debt within this grace period to save. The interest goes up after the term, and you can expect to pay the average credit card rate of nearly 21%.

Note that opening an account can impact your credit score. It could drop a few points when the lender conducts a hard inquiry. It will bounce back as long as you make payments on time.

Debt management plans

Consult a non-profit credit counseling agency to design a debt management plan (DMP). It will negotiate with lenders on your behalf to lower your debt cost.

Pay the reduced amount to the agency and get regular progress reports. You may incur a fee when signing up for a DMP.

Home equity loans and lines of credit

Home equity loans offer some of the lowest interest rates. If you’ve built up equity in your home, you could use it to get a loan. This amount is your home’s value minus your mortgage balance.

You can convert up to 80–85% of that amount into a home equity loan. It’s like a second mortgage that you pay off in 5–30 years.

Qualifying for home equity loans is easier with your house as collateral. Lenders are more inclined to approve it, as there’s less risk. If you default on payments, they can foreclose your property. Ensure you meet all your payments to avoid losing your home.

You may incur some charges, including appraisal and closing costs. The valuation fee depends on the location and property type.

With a home equity line of credit (HELOC), you won’t receive the loan amount in a lump sum. Instead, you draw from a cash pool during the contract tenure.

Interest rates tend to be lower than personal loans and credit cards. You only pay the interest during this period. HELOCs have variable interest rates, meaning that the repayment amount may fluctuate. Be prepared for this, as you could lose your home if you can’t pay.

Be disciplined not to use the drawdown for other purposes. Repay the line of credit, as the loan may amortize quickly and increase your repayment.

The other downside to consider is a drop in property values. You could end up owing more than your house is worth.

Exploring other financial options

Aside from traditional financing, consider borrowing from online and other lenders. It’s easier to qualify for these funding options. Before choosing a financier, be sure to check its reputation and credibility.

Having a wealthy family member willing to help is ideal. You’ll probably enjoy better terms than those offered by other lenders. Keep the transaction professional, including signing an agreement, to avoid disrupting the relationship.

Tips for managing debt after consolidation

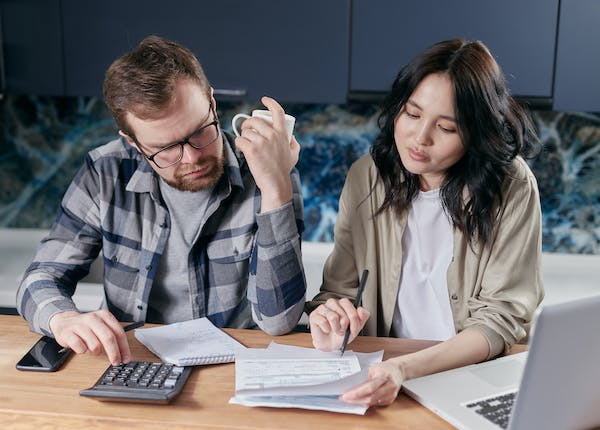

One of the reasons people get into a financial bind is poor debt management. Prevent this from repeating with your new loan by applying the following tips.

Creating a budget and financial plan

A budget is your road map to achieve financial independence through your new loan. It helps you plan your spending to make your repayments in full and on time. Adjust your other expenditure to accommodate the loan payments.

Remember that a budget only works if you stick to it.

Avoiding accumulating new debt

Your debt-free goal can be successful if you pay off your loan without adding new debt. Review your spending habits and make necessary changes to avoid repeating the problem.

Keep to your budget and be vigilant of unplanned expenses. It may be challenging initially, but refrain from spontaneous spending. These lifestyle changes will pay dividends in the long run.

Building an emergency fund

Having an emergency fund is essential to financial security. You’ll never know when an unexpected event can disrupt your plan by costing money.

Allocate a portion of your income to an emergency fund and include it as a priority expense. You’ll build up savings over time for rainy days without affecting your loan repayments.

Seeking professional financial advice

Unless you’re a financial expert, get professional debt management advice. Having an action plan helps you achieve your goal. You’ll also benefit from knowledge and experience to avoid unexpected pitfalls.

Get your debts in order

If you have debt problems, act before it gets out of control. Merging your borrowings into one helps you manage repayments without stress. All you need to do is pay off a single loan.

Follow our advice on choosing the best debt consolidation loans in the USA to find one that works for you. Knowing the evaluation criteria helps you make an informed decision.

Remember that selecting the right financial vehicle is only part of the solution. Understanding and managing your new debt is as important. The most vital step is changing your spending habits to avoid falling into the trap again.

Contact United Financial Network and be on your way to regaining financial independence.