Understanding medical debt relief programs

The benefits of medical debt relief programs

Get medical debt relief with United Financial Network

A surefire solution to living debt-free

Why should you consider medical debt relief programs? The simple answer is that you deserve to live a stress-free, fulfilling life. You may not achieve this milestone with debts constantly milking you dry. Freedom is crucial to happy living.

Did you know over 100 million American adults have medical debt? The current total debt is a whopping $195 billion. These arrears contribute to more than half of bankruptcies in the USA. They plague many lives and cause a lifetime of dependency, especially for the uninsured.

The way out? One of the best ways to navigate medical bills is by enrolling in a reputable relief program. These initiatives offer strategies to help ease unbearable financial burdens. They provide solutions to curb compounding arrears and save you some dollars.

What happens when you get slapped with medical bills beyond your ability? Discover how an expertly structured relief program can save the day.

Understanding medical debt relief programs

Medical debt relief programs are strategies or initiatives for debt management and repayment. They aim to help you navigate while cutting the financial burden of medical expenses. These programs restore life’s balance and meaning by getting debt under control.

Most people struggle to pay their medical bills due to:

- Exorbitant healthcare costs

- Lack of insurance coverage

- Unexpected medical emergencies

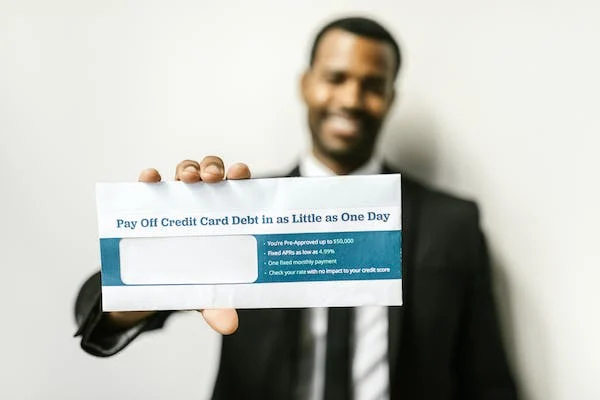

A debt relief program secures better terms, slashes the amount you owe, or cuts your interest rate. It can also consolidate your debts into a single fixed monthly payment to ease the pressure. This approach simplifies payments, all while lowering monthly obligations.

Who provides medical debt relief solutions? Let’s explore the three major types of programs below.

Government medical debt relief programs

These relief programs anchor on public funds. They rely on taxpayer money and operate through federal, state, or local governments. The most popular government-sponsored debt relief programs are Medicaid and Medicare.

Medicaid offers free or low-cost healthcare insurance to low-income individuals. It’s the largest government debt relief program, serving over 70 million Americans.

Insurance eligibility depends on income, assets, age, and household size. Qualification requirements may vary by state. The typical threshold is a monthly income below $2,250.

Most states don’t consider your personal property like car and house. They focus on cash in hand and savings to quantify your assets. The quickest way to apply is through your state agency.

Medicare is a federal healthcare debt relief program. It offers medical assistance or insurance to seniors over 65 years. Younger adults living with disabilities may also qualify. This initiative has subprograms that cover diverse medical needs and procedures.

Nonprofit medical debt relief programs

Nonprofit medical debt relief programs rely on grants and donations to fund patients. They target people with medical-related financial hardship. Their eligibility criteria vary by specific circumstances and medical conditions.

Some renowned organizations that assist with medical bills include:

- HealthWell Foundation. This oranization operates to bridge the gap in health insurance. Patients receive funds for prescription copayments and health insurance premiums. Additionally, it helps with medical care travel costs and pediatric treatment. Health insurance is necessary to qualify.

- Patient Access Network Foundation. It funds underinsured patients with rare, life-threatening, chronic conditions. It also caters to copayments, health insurance premiums, and travel expenses. To qualify, you must be receiving eligible treatment.

- Patient Advocate Foundation. Its case managers provide zero-cost services to qualifying patients. It aims to lighten the financial burden of healthcare diagnosis. It also offers copay funding and financial grants. You must have a chronic illness to qualify.

Private medical debt relief programs

Private debt relief programs typically run through funds from investors or individual owners. They offer similar services to governments and nonprofits on a more personalized level. While they aim for revenue, they prioritize easing your medical financial stress hassle-free.

Their eligibility criteria vary by income or creditworthiness. It may also hinge on customized contractual agreements like:

- Loan refinancing

- Fee waivers

- Interest rate reduction

- Debt consolidation

- Loan limit extension

Some private relief programs focus on debt settlement services. They negotiate with creditors on your behalf to reduce the amount of debt you owe.

The eligibility criteria for medical debt relief programs vary but may include:

- Financial hardship. Most programs assess your employment status and income levels. They can further narrow it down to specific indicators.

- Medical necessity. Some programs demand proof of medical urgency. They may ask for document evidence for your medical condition, treatment, or expenses.

- Insurance status. Particular debt relief programs focus on those without adequate insurance coverage.

- Debt level. How much medical debt do you owe? Some relief programs can only finance you up to a certain threshold.

- Residency or citizenship status. Most government programs limit their assistance to US citizens or residents.

- Demographic dynamics. Some relief programs target specific communities and age groups. Others finance those with particular disabilities.

Once you’re eligible for debt relief, most programs require:

- Application form. These forms require information about your medical condition, financial situation, and unpaid debts.

- Medical evidence. Medical bills, records, or statements may be necessary to verify the extent of your need.

- Income proof. You may need to provide statements like tax returns to justify financial need.

- Proof of debt. It may include billing statements and documented communication with your creditor.

- Insurance data. Debt relief programs may demand info on your current insurance coverage. Policy documents and coverage scope help assess your financial need.

- Identification documents. Verifying your identity is crucial to monitor your progress. You may need to provide your Social Security card or driver’s license.

- Credit report. Sometimes, a credit report may summarize your financial situation.

The benefits of medical debt relief programs

Are you tired of being stuck in the maze of healthcare bills? Try medical debt relief programs for their many benefits. The below list identifies some of the most valued ones.

Immediate financial relief

Debt management programs provide immediate relief for those facing medical arrears. They help with bill negotiation, reduction, or entire clearance.

These programs may negotiate with debt collectors or medics to lower your debt. They could also advocate for partial or entire medical debt forgiveness.

You get the incentive to rise above overwhelming costs. You can avoid the accrual of interest and additional fees.

Protection from aggressive debt collection practices

Reputable debt relief programs shield you from aggressive debt collection practices. They protect you from constant letters, calls, and potential legal tussles by creditors. They offer reprieve by limiting or halting communication from collection agencies.

Debt relief programs may also offer legal assistance to curb unfair collection processes. They ensure everything unfolds within the bounds of the law and dignity.

Potential impact on credit scores

The intervention of debt relief programs can positively impact your credit scores. Removing or reducing your debt is synonymous with clearing your name. It may improve your credit score gradually.

These programs negotiate your debt settlements. Creditors capture your reduced payments as a settled debt, not an outstanding balance. Even better is medical debt forgiveness. It may trigger the removal of unpaid debts from your credit report.

Get medical debt relief with United Financial Network

Where does the search for reliable medical debt relief programs begin? Look no further than United Financial Network (UFN). We take pride in our unmatched expertise and personalized approach. Our friendly team aims to secure your financial freedom so you can live optimally.

Does everyone qualify? UFN employs dynamic eligibility criteria to accommodate as many people as possible. To qualify for our relief program, you must:

- Be at least 18 years old and comply with citizenship requirements.

- Prove you’re not receiving financial aid elsewhere for the same medical expense.

- Demonstrate financial challenges. Do you have an unmanageable debt? Are you avoiding filing for bankruptcy? Does your income fall below the federal poverty level?

- Prove your medical necessity and the incurred medical debt. You should be currently undergoing treatment for the stated disease.

- Show proof of insurance that covers your medical treatment. Your insurance membership ID is also necessary.

- Receive treatment within the US or its territories.

Here’s our step-by-step application process for debt relief services:

- Research and gather enough information. Familiarize yourself with our services and eligibility criteria. Fill out and submit our contact form for a no-obligation quote.

- We will review your request and assess your needs before calling you back. Afterward, we will get in touch to discuss your options further.

- We propose an affordable solution once we understand your financial situation. We then customize the plan to your unique needs and budget. Our experts look into ways to restructure your debt to favor your growth.

- After we approve your request, we get your journey started to being debt-free. We aim to help you save as much as possible.

UFN may request documentation to assess your eligibility and medical debt’s scope. Among others, we typically require:

- Valid identification documents

- Medical statements and bills

- Proof of income

- Credit report

- Insurance information

What our clients have to say

UnitedFN is a trusted partner for medical debt relief. We take pride in a BBB Rating & Accreditation and a 4-star rating in Trustpilot.

But don’t just take our word for it. Check out the latest UnitedFN customer reviews for a glimpse into our quality:

Melissa A. from Brentwood, CA, had a total debt of $49,365 with monthly payments of $739. She approached our friendly experts for help and saved $12,202. Her remarks say it all.

“This gave me so much breathing room for actually living. Credit cards and student loans can weigh you down very fast.”

Andrew J. from Tempe, AZ, confesses getting out of a dungeon through our interventions. He had a total debt of $61,432 with monthly payments of $684. We helped him save up to $15,068. If that’s not life-changing, what is? Here’s what he has to say.

“I never thought I could get out of this hole. They gained my trust from day 1.”

UnitedFN traverses borders to offer unmatched debt relief solutions to make life livable. Joanne H. from Dallas, TX, found her life again after rebounding from a rough patch. At least she can afford to fend for her children again.

“I was struggling as a single mother with these high-interest credit card balances. This saved us.”

From a total debt of $37,501 with monthly payments of $465, we gave Joanne a complete turnaround. She ended up saving a whopping $13,754.

Numbers don’t lie, so why not be part of the savings bandwagon? Don’t drown in medical debt when you can access quick relief from a reliable team.

Besides the number-centric reviews, here’s what Jack Forsythe, USA says about us:

“Great support staff. Konrad was upfront about the process and prepared me for what was to come. Will update in a few months as well.”

Let’s wrap up the reviews with sentiments from Brenda Grisby, USA:

“Loan process was smooth and sweet. Konrad guided me the entire way and explained every single question I had (and trust me, there were many). He even kept in touch with me for a few weeks after everything was authorized. Highly recommend them in general, and for the easiest route, speak with Konrad.”

A surefire solution to living debt-free

Compounding medical debt can be heart-wrenching. In worst cases, it may deplete your life savings and leave you dependent. What a life! You don’t deserve this frustration.

Turn to trusted medical debt relief programs for favorable debt management. Agree on the best terms, pay at your pace, and make life worth living. These programs can be by the government, nonprofit agencies, or private firms.

Before enrolling in a program, understand the eligibility criteria and application process.

Debt relief initiatives restore dignity and vibrancy to your life. They provide immediate financial reprieve while protecting you from aggressive collection practices. A well-reasoned program can even improve your credit scores.

Do you have challenges with your medical expenses? Seek the expert intervention of United Financial Network. We offer free consultation, personalized assessment, and transparent terms. What could be friendlier? Contact us today for a no-obligation quote and first-class services.